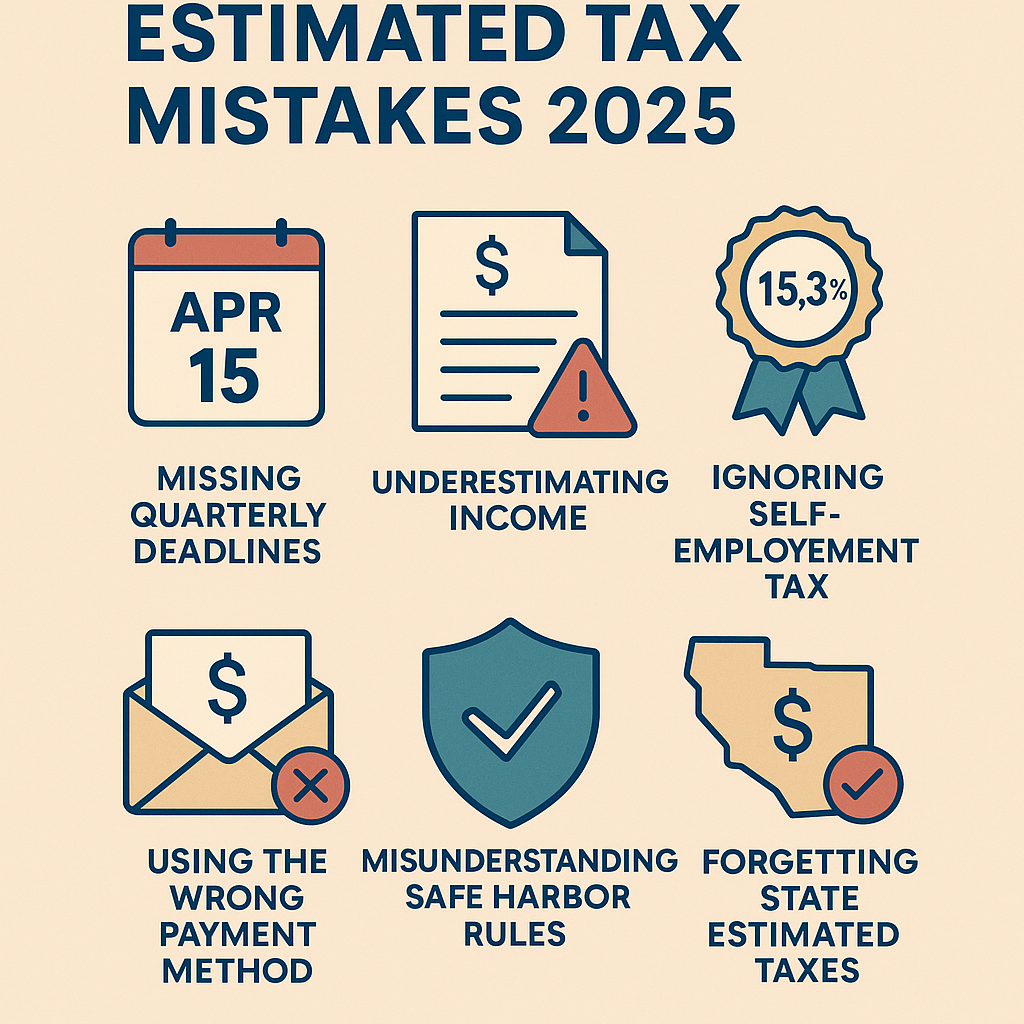

The six most common estimated tax mistakes in 2025 — from missing deadlines to misunderstanding IRS safe harbor rules — and how they can lead to an underpayment penalty.

Common Estimated Tax Mistakes (and How to Avoid an Underpayment Penalty in 2025)

If you’re self-employed, freelancing, or running a side hustle, you probably know about quarterly estimated taxes. But even seasoned taxpayers stumble into estimated tax mistakes that can trigger costly penalties. In 2025, avoiding an underpayment penalty 2025 starts with knowing the rules.

Why Estimated Taxes Matter

Estimated taxes cover income without federal withholding—like freelance gigs, contract work, or small business revenue. Payments are due quarterly, and failing to pay enough can result in an IRS penalty. Learn more from the IRS: IRS Estimated Taxes.

Top Estimated Tax Mistakes

1. Missing Quarterly Deadlines

Payments are due April 15, June 15, September 15, and January 15. Even a short delay may trigger penalties. See deadlines: IRS Payment Options.

2. Underestimating Income

Projecting too low to reduce quarterly payments can backfire if actual earnings are higher.

3. Ignoring Self-Employment Tax

Estimated payments must include income tax plus 15.3% for Social Security and Medicare.

4. Using the Wrong Payment Method

Checks risk delay. Online options like Direct Pay and EFTPS are faster and more secure.

5. Misunderstanding Safe Harbor Rules

You avoid penalties if you pay either:

- 90% of current year’s tax liability, OR

- 100% of prior year’s tax (110% if AGI > $150,000).

6. Forgetting State Estimated Taxes

Many states also require quarterly estimated tax payments. Don’t overlook them.

How to Avoid an Underpayment Penalty in 2025

- Set reminders for IRS deadlines.

- Use IRS calculators or tax software to project correctly.

- Pay online through Direct Pay or EFTPS.

- Track deductions to avoid overpaying.

- Check safe harbor rules for penalty protection.

Key Takeaways

Most estimated tax mistakes involve timing, projections, or safe harbor missteps. By paying on time and using IRS rules, you can prevent an underpayment penalty 2025.

More Resources

For tools to stay penalty-free, explore the Side Hustle Guide, OIC Checklist, and Home Office Toolkit.

Disclaimer

Disclaimer: The information provided in this blog post is for informational purposes only and should not be construed as legal, tax, or accounting advice. Tax situations are often complex and highly specific to the individual or business. You should contact a qualified tax expert directly to discuss your particular circumstances. Nothing herein is intended to, nor does it, create an attorney-client or advisor-client relationship. For individual guidance, please contact us directly.