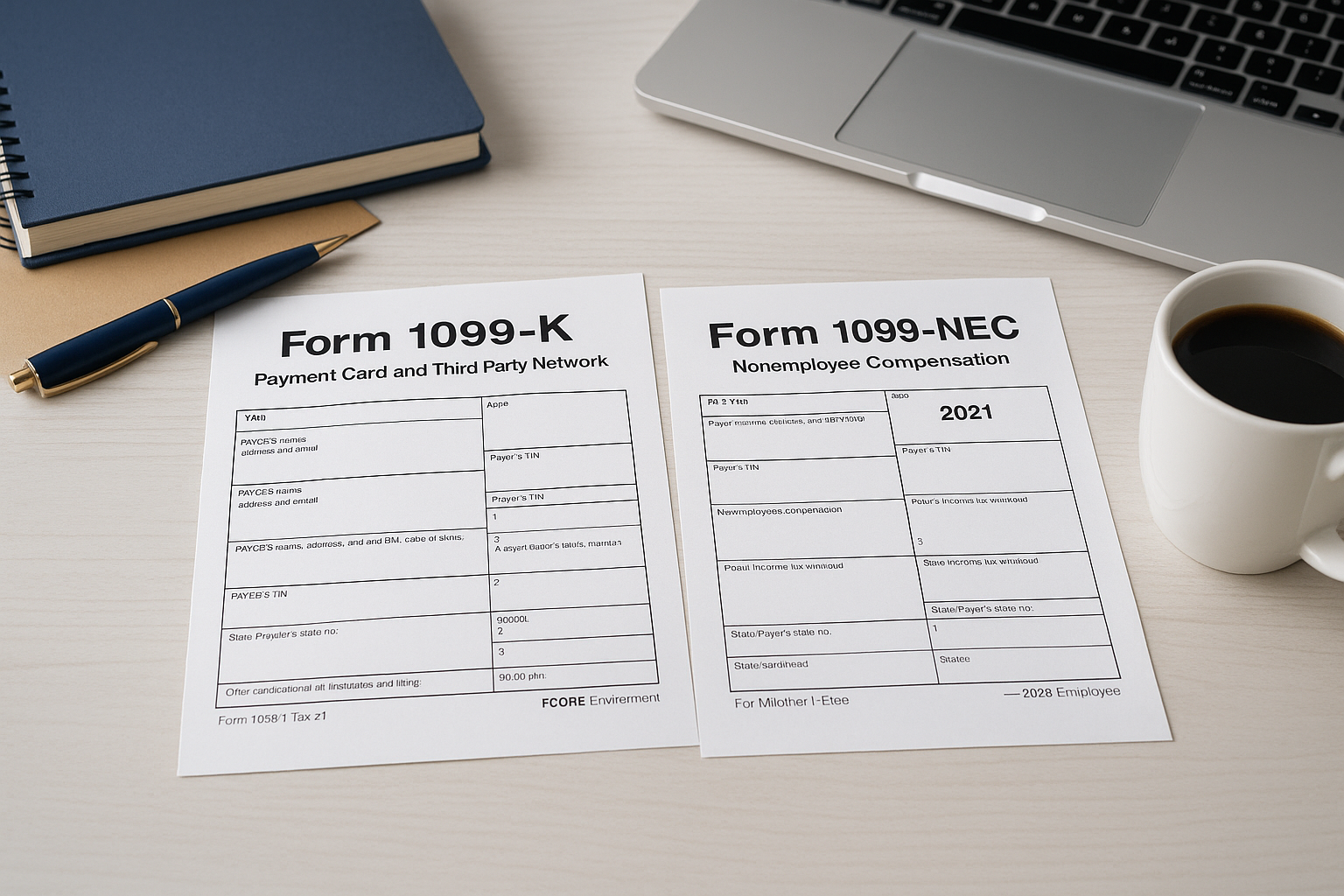

Understanding the difference between Form 1099-K and 1099-NEC is key for 2025 side hustle tax compliance.

Form 1099-K vs. 1099-NEC: What Side Hustlers Need to File in 2025

If you run a side hustle in 2025, understanding Form 1099-K vs. 1099-NEC is essential for accurate tax reporting. These two IRS forms often cause confusion for freelancers, gig workers, and online sellers. Both forms report income, but they come from different sources, have different issuing rules, and directly impact how you file your side hustle taxes. Let’s break down the differences, thresholds, and reporting requirements so you can stay compliant and avoid penalties.

Why Form 1099-K vs. 1099-NEC Matters for Side Hustlers

Thanks to lower IRS thresholds, more side hustlers than ever will get one—or both—of these forms. Whether you sell on Etsy, invoice clients directly, or get paid through PayPal, understanding the Form 1099-K vs. 1099-NEC rules can save you from costly mistakes. If you’re new to reporting side hustle income, see our how to report side hustle income guide for foundational tips.

Form 1099-NEC in the Form 1099-K vs. 1099-NEC Comparison

The 1099-NEC reports nonemployee compensation of $600 or more from a single client. It’s issued by businesses or individuals who hire you directly, not through a payment processor.

- Who sends it? Direct clients paying via check, ACH, or wire transfer.

- Threshold: $600 or more from one payer in a calendar year.

- Example: A marketing agency pays you $1,000 for a project. They issue a 1099-NEC.

Form 1099-K in the Form 1099-K vs. 1099-NEC Comparison

The 1099-K reports gross payments processed through third-party networks like PayPal, Venmo (business transactions only), Stripe, or marketplaces like Etsy, Airbnb, and eBay.

- Who sends it? Payment processors and online marketplaces.

- Threshold in 2025: $600 in total gross payments—regardless of the number of transactions.

- Example: You sell $750 worth of handmade goods on Etsy. Etsy sends you a 1099-K.

Form 1099-K vs. 1099-NEC: Key Differences

| Form | Who Issues It | What It Reports | 2025 Threshold |

|---|---|---|---|

| 1099-NEC | Client or business hiring you directly | Nonemployee compensation | $600+ |

| 1099-K | Payment processor or marketplace | Gross payments processed | $600+ |

When You Might Receive Both Forms

Some side hustlers get both. For example: A designer earns $1,200 from a local business (1099-NEC) and $2,000 selling downloads on Etsy (1099-K). Our business vs. hobby guide explains how classification affects your taxes and deductions.

What If You Don’t Get Either Form?

Even without receiving a form, all side hustle earnings are taxable. The IRS requires reporting every dollar per IRS guidelines. Omitting income—whether intentional or not—can trigger audits and penalties.

How to Report Income from Form 1099-K vs. 1099-NEC in 2025

- Gather all 1099 forms and other payment records.

- Report your business income on Schedule C (Form 1040).

- Deduct eligible business expenses to reduce taxable income—see our side hustle deductions guide.

- If you expect to owe $1,000 or more, make quarterly estimated tax payments through IRS Direct Pay.

Best Practices for Managing Form 1099-K vs. 1099-NEC Data

- Open a dedicated business bank account.

- Use accounting software to log all transactions.

- Download annual payment summaries from PayPal, Stripe, or Etsy.

- Save all receipts and invoices for at least three years.

Bottom Line on Form 1099-K vs. 1099-NEC for Side Hustlers

With the $600 threshold applying to both forms in 2025, more side hustlers will face Form 1099-K vs. 1099-NEC reporting. The key is knowing the difference, keeping thorough records, and using the right reporting methods to stay IRS-compliant. For a comprehensive prep plan, download our Complete Guide to Building and Taxing Your Side Hustle Right.

Disclaimer: The information provided in this blog post is for informational purposes only and should not be construed as legal, tax, or accounting advice. Tax situations are often complex and highly specific to the individual or business. You should contact a qualified tax expert directly to discuss your particular circumstances. Nothing herein is intended to, nor does it, create an attorney-client or advisor-client relationship. For individual guidance, please contact us directly.