IRS Offer in Compromise: Settle Your Tax Debt

Owe more to the IRS than you can realistically pay? You’re not alone. The IRS expects full payment, but many taxpayers qualify to settle for less through an Offer in Compromise (OIC).

- Reduce overwhelming tax debt to an affordable level

- End IRS collections pressure and regain control

- Protect your income, assets, and financial future

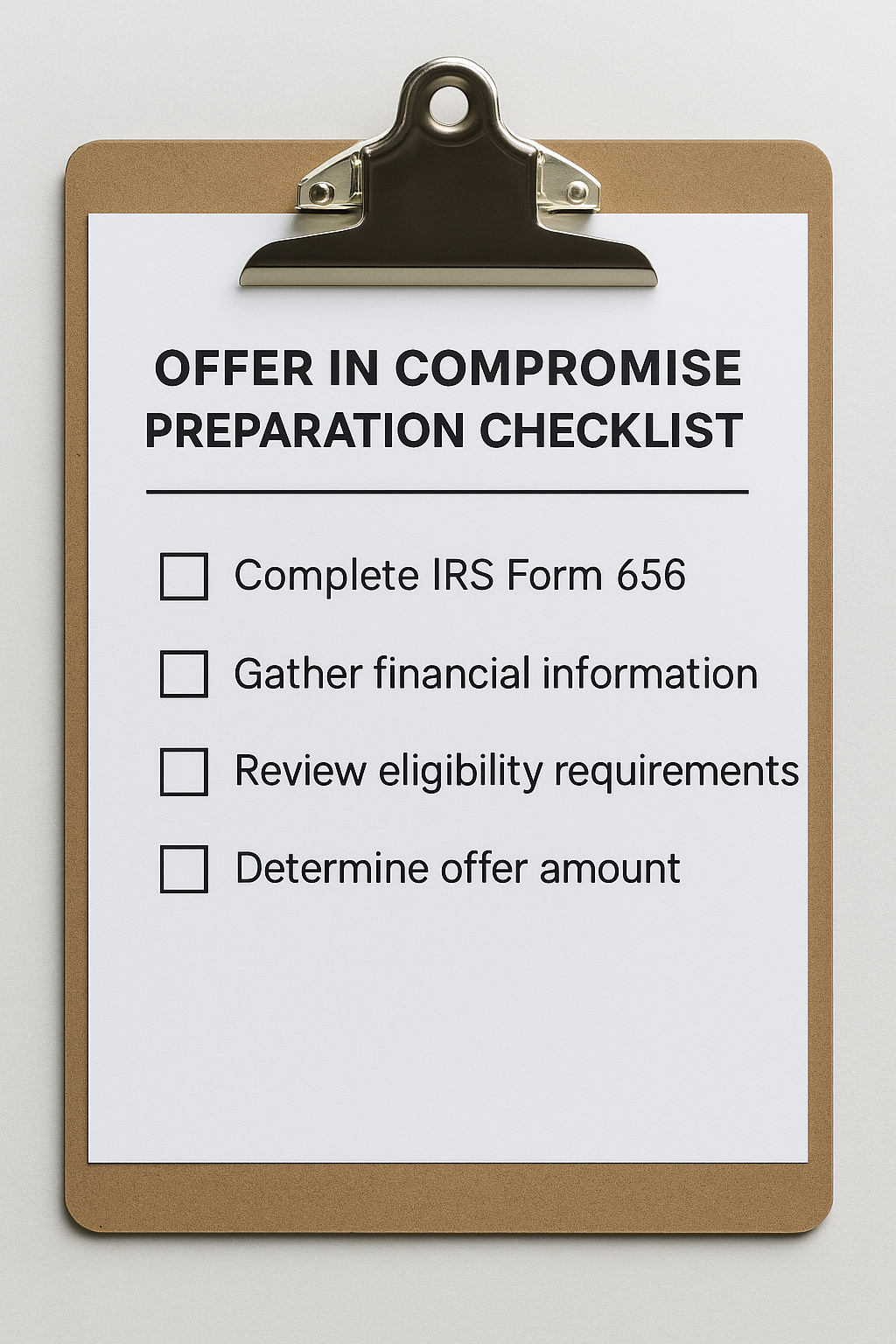

👉 Get the Free OIC Preparation Checklist

What is an Offer in Compromise?

An Offer in Compromise is an agreement with the IRS that allows taxpayers to settle their tax debt for less than the full amount owed.

It applies to individual income taxes, business taxes, payroll liabilities, penalties, and more. The IRS reviews your full financial picture to decide whether your offer is the most it can reasonably collect in a reasonable time.

How the IRS Decides

The IRS considers your ability to pay, income, necessary living expenses, and asset equity. If your offer equals or exceeds what the IRS believes it can collect within a set period, it may accept your offer.

Quick Eligibility Signals

- You can’t repay the full debt within a reasonable period

- Your income and necessary expenses leave little to no disposable income

- You have limited equity in assets compared to your liability

- You’re current on all required filings (or can get current quickly)

Before You Apply

- All tax returns filed and current on estimated payments/deposits

- No open bankruptcy proceedings

- Initial payment submitted with the offer

Two Payment Options

Lump Sum Cash: Pay 20% upfront; balance in ≤ 5 payments within 5 months of acceptance.

Periodic Payments: First payment with the offer; continue monthly payments over 6–24 months during IRS review (missing a payment can cause a return of the offer with no appeal).

If accepted, payments made during review are applied to your offer amount. You must remain fully compliant for five years—late filings or payments can default your offer.

Asset valuation can be complex. Professional guidance helps ensure your offer reflects your true ability to pay.

✅ Free Offer in Compromise Checklist

Get our step-by-step IRS OIC Preparation Checklist. Avoid common mistakes, gather the right docs,

and present a stronger offer from day one.

You’ll also get exclusive tax tips and IRS updates from TaxLane. Unsubscribe anytime.

Work With a Trusted Expert to Protect Your Finances

Don’t face the IRS alone. A qualified tax specialist can build your case, maximize your chances of approval, and protect your financial future.